Admis Asia: Insights into the Dynamic Asian Market

Exploring the latest trends and developments across Asia.

Insurance Policies: A Love Story You Didn't Know You Needed

Discover the unexpected romance in insurance policies! Uncover why these love stories are essential for your peace of mind.

Understanding the Different Types of Insurance Policies: Which One is Right for You?

Understanding the different types of insurance policies is crucial for making informed decisions about your personal and financial security. There are various categories of insurance, each designed to protect against specific risks. The most common types include:

- Health Insurance - Covers medical expenses and ensures access to necessary healthcare services.

- Auto Insurance - Provides financial protection against vehicle-related accidents and damages.

- Homeowners Insurance - Protects your home and personal belongings from damage or theft.

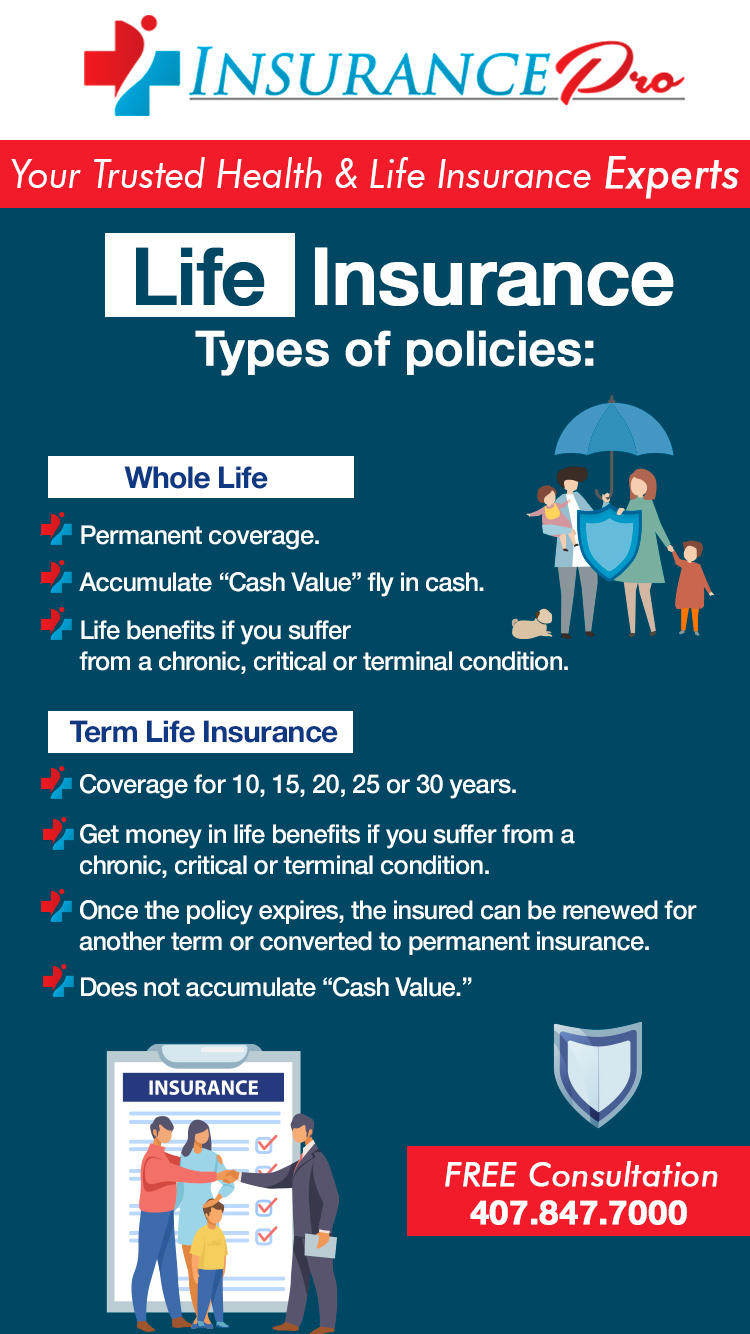

- Life Insurance - Offers financial support to your beneficiaries in case of your untimely passing.

Choosing the right insurance policy depends on your individual needs and circumstances. It's essential to assess your risk factors and evaluate your current financial situation to determine which policies will provide the best protection. For instance, if you have dependents, a strong life insurance plan is imperative. Similarly, if you own a car or home, investing in auto and homeowners insurance can safeguard your assets. Don't hesitate to consult with insurance professionals to tailor a plan that aligns with your lifestyle and budget.

Why Your Insurance Policy is Like a Good Relationship: Key Components for a Lasting Bond

Much like a good relationship, a strong insurance policy is built on trust and communication. When you invest in a policy, you place your faith in the insurer to protect your assets and provide support during challenging times. A comprehensive understanding of your policy terms and coverage options is crucial, as it fosters transparency and sets clear expectations. Just as in a relationship where both partners openly discuss their needs, your insurer should be approachable, offering you clarity and assistance whenever you have questions or concerns.

Another vital component of both a lasting relationship and a reliable insurance policy is commitment. In a healthy partnership, both parties are dedicated to supporting each other through life's ups and downs. Similarly, your insurance policy should reflect a commitment to your well-being, featuring adequate coverage tailored to your unique circumstances. Regularly reviewing and updating your policy is akin to nurturing your relationship; it ensures that you remain aligned with your goals and can confidently face any challenges that come your way.

5 Common Myths About Insurance Policies Debunked: What You Really Need to Know

When it comes to insurance policies, many people are misled by common misconceptions that can ultimately affect their financial well-being. One prevalent myth is that all insurance policies are the same. This couldn't be further from the truth. Different insurers offer varied coverage options, premium costs, and claim processes. It's crucial to understand the specifics of each policy and not assume that all plans provide identical protection. Additionally, some believe that they don't need insurance if they are healthy. This is a dangerous assumption; unforeseen accidents or sudden illnesses can happen to anyone, and having the right insurance can provide peace of mind.

Another common myth is that filing a claim will automatically result in higher premiums. While it’s true that frequent claims can lead to increased rates, a single claim is often viewed in the context of your overall insurance history. Furthermore, many people think that insurance policies will cover everything they need. In reality, most policies come with exclusions and limitations that policyholders must be aware of. Understanding what your policy really covers and what it does not is essential to avoid unexpected gaps in protection. Lastly, there's a misconception that loyalty to one insurer guarantees better rates. In fact, it’s often beneficial to shop around periodically, as competition can lead to better premiums and coverage options.