Admis Asia: Insights into the Dynamic Asian Market

Exploring the latest trends and developments across Asia.

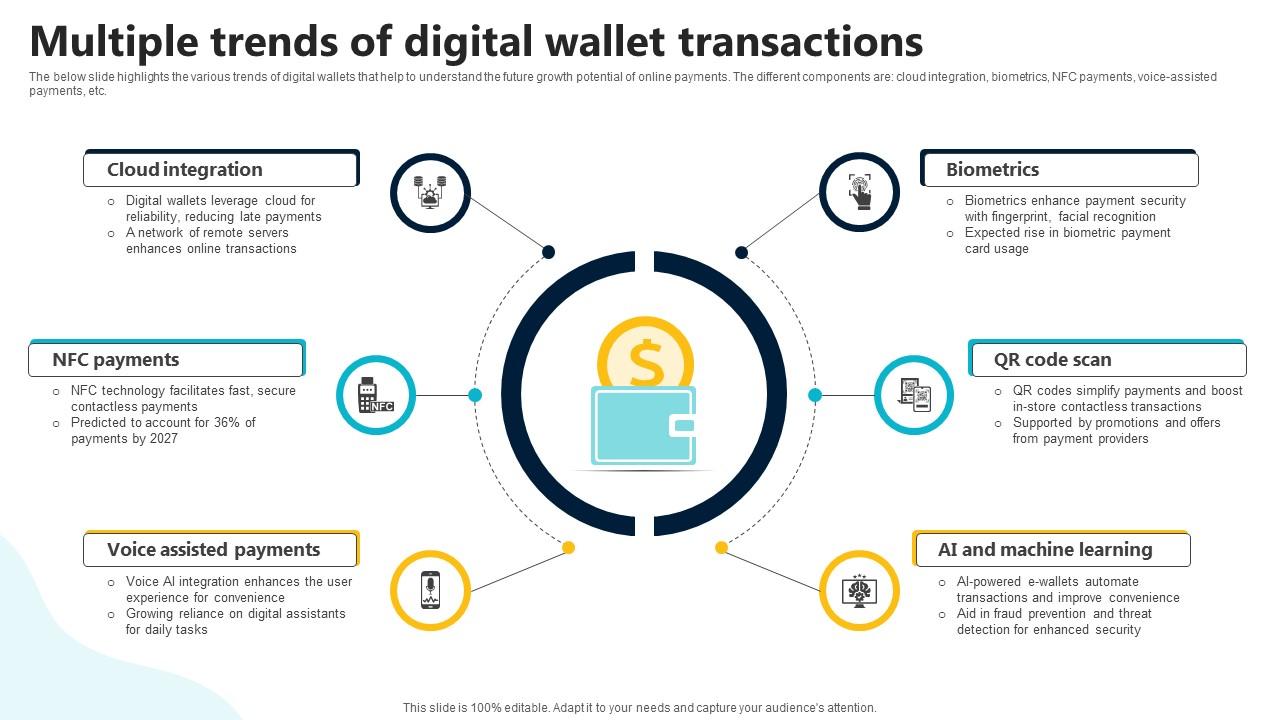

Seamlessly Spending: Navigating the World of Digital Wallet Integrations

Unlock the future of payments! Discover how to effortlessly integrate digital wallets and elevate your spending experience today.

Understanding Digital Wallet Integrations: Benefits and Features

In today's digital landscape, digital wallet integrations are becoming increasingly essential for businesses aiming to enhance their payment processes. By incorporating digital wallets into their systems, companies can offer customers a streamlined and efficient way to complete transactions. With features such as one-click payments, security enhancements, and support for multiple currencies, digital wallets eliminate the friction often associated with traditional payment methods. This shift not only improves the user experience but also encourages customer loyalty, as consumers are more likely to return to businesses that offer convenient and secure payment options.

Moreover, the benefits of digital wallet integrations extend beyond just consumer convenience. From an operational perspective, businesses can enjoy reduced transaction costs and increased processing speed. By utilizing analytics features integrated within many digital wallet platforms, companies can gain valuable insights into customer behavior and preferences. Additionally, the robust security measures associated with digital wallets, such as encryption and tokenization, help to safeguard sensitive data, thereby enhancing trust and compliance with regulatory standards. Embracing this technology can position businesses for success in a rapidly evolving marketplace.

Counter-Strike is a highly popular multiplayer first-person shooter game that pits teams of terrorists against counter-terrorists. Players can engage in various game modes, where teamwork and strategy are crucial for success. For those interested in enhancing their gaming experience, using a betpanda promo code can offer exciting opportunities. The game is renowned for its competitive nature and has a vibrant esports scene.

How to Choose the Right Digital Wallet for Your Business

Choosing the right digital wallet for your business is crucial for streamlining transactions and enhancing customer satisfaction. Start by evaluating the features you need, such as transaction fees, security measures, and compatibility with your existing payment systems. Make a list of the top contenders and compare them based on factors like ease of use, customer support, and integration capabilities. Additionally, consider if the wallet offers multi-currency support, which can be essential if you deal with international clients.

Once you have narrowed down your options, it's important to read user reviews and testimonials to gauge real-world performance. Look for feedback on security issues, transaction speed, and overall reliability. Testing out a few wallets through trial accounts can also provide insight into which platform resonates best with your business model. Ultimately, the right digital wallet will not only enhance your operational efficiency but also foster trust and loyalty among your customers.

Common Questions About Digital Wallets: Security, Fees, and Compatibility

Digital wallets have become increasingly popular, but many users still have common questions regarding their security. One of the primary concerns is whether the information stored in digital wallets is safe. Most reputable digital wallet providers use advanced encryption technology to protect user data. Additionally, features such as two-factor authentication (2FA) can further enhance security, making it harder for unauthorized users to access your account. It's essential to choose a well-reviewed digital wallet that prioritizes user security to mitigate risks.

Another frequent question revolves around fees associated with digital wallets. While many wallets are free to download and use, some may charge transaction fees, especially for conversions between currencies or when transferring funds to bank accounts. It's vital to read the fine print and understand the fee structure before committing to a digital wallet. Lastly, compatibility is crucial; ensure that the wallet you choose works seamlessly with your devices and the intended payment platforms. This will enhance your overall user experience and ensure smooth transactions across various services.